This AskRegs Knowledgebase Q&A was updated on to include U.S. The following guidance is still relevant depending on context and/or application of the waiver.

Irss stimulus verification#

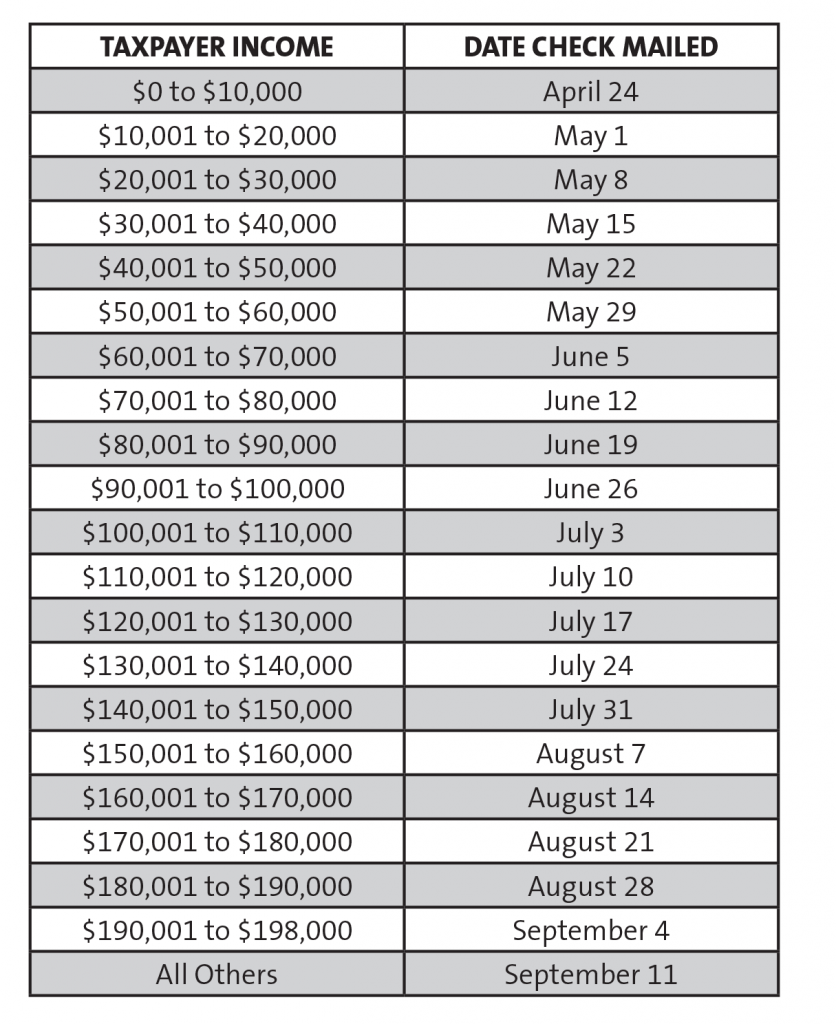

See Dear Colleague Letter GEN-22-06 and AskRegs Q&A, How Do We Implement the Verification Waiver For the Remainder Of 2022-23?, for guidance. Department of Education (ED) waives verification of all FAFSA/ISIR information, except for identity/Statement of Educational Purpose in Verification Tracking Groups V4 and V5. Instead, officials are encouraging people to file 2020 tax returns even if they aren’t required in order to receive the stimulus money.2022-23 Verification Waiver: Beginning and for the remainder of the 2022-23 FAFSA processing and verification cycle, the U.S. The agency will also automatically send the money to low-income people who don’t normally file taxes but submitted their personal information online to receive the stimulus payment last year. The IRS can easily reach people who have filed either their 2019 or 2020 tax return because their bank account information or address is on file. But if your income fell in 2020, filing your tax return now – before the payments go out – may mean you’ll get a bigger check. If your 2019 income was less than your pay in 2020, you will not owe back any money. If not, it will be based on the 2019 return or the information submitted through an online portal set up last year for people who don’t usually file tax returns. If they’ve already filed a 2020 return by the time the payment is sent and it has been processed, the IRS will base eligibility on their 2020 adjusted gross income.

The new income thresholds will be based on a taxpayer’s most recent return. On what year are the income limits based? It cuts off individuals who earn at least $80,000 a year of adjusted gross income, heads of households who earn at least $120,000 and married couples who earn at least $160,000 – regardless of how many children they have. Lawmakers narrowed the scope of the payments this time so that not everyone who received a previous check will be sent one now. But then the payments gradually phase out as income goes up.

Irss stimulus full#

The full amount goes to individuals earning less than $75,000 of adjusted gross income, heads of households (like single parents) earning less than $112,500 and married couples earning less than $150,000. Unlike prior rounds, families will now receive the additional money for adult dependents over the age of 17. Families will receive an additional $1,400 per dependent, so a couple with two children could receive up to $5,600. The new payments are worth up to $1,400 per person and are expected to reach 85% of households, according to the White House. On Tuesday, the IRS said it was continuing to review data received for veteran benefit recipients and expects a forthcoming payment date “soon.” People who receive Veterans Affairs pension and don’t have a recent tax return on file are also still waiting for their stimulus payments. “Social Security employees have literally worked day and night with IRS staff to ensure that the electronic files of Social Security and SSI recipients are complete, accurate, and ready to be used to issue payments,” Saul said. that day, noting that it was a week sooner than the agency was able to provide the information to the IRS last year when the first round of stimulus payments went out. On Thursday, Social Security Administration Commissioner Andrew Saul put out a statement to say his agency sent the files by 9 a.m. The Social Security Administration shared the beneficiaries’ contact information with the IRS last week and the money will likely be delivered in the same manner as regular benefits, whether that’s a direct deposit or a check in the mail.īut the information wasn’t sent to the IRS until after some Democratic lawmakers raised alarm over the delay and sent a letter last week requesting the files be transferred within 24 hours. They will receive their stimulus payment automatically and should start seeing the status of their payments this weekend using the government’s online Get My Payment tool. The delay affects those who receive Social Security, Supplemental Security Income, or Railroad Retirement Board benefits. But Social Security recipients who don’t have a 2019 or 2020 tax return on file – typically because their income is below the threshold for filing – are still waiting.

0 kommentar(er)

0 kommentar(er)